The process of selecting a return for examination usually begins in one of two ways. One way is to use computer programs to identify returns that may have incorrect amounts. These programs may be based on information returns, such as Forms 1099 and W-2; on studies of past examinations; or on certain issues identified by other special projects. Another way is to use information from compliance projects that indicates that a return may have incorrect amounts.

Should Sales Returns Be Deducted From Total Revenue? – smallbusiness.chron.com

Should Sales Returns Be Deducted From Total Revenue?.

Posted: Wed, 13 Jul 2016 22:38:37 GMT [source]

See Form 8962 and its separate instructions and use Pub. 974 if the insurance plan established, or considered to be established, under your business was obtained through the Health Insurance Marketplace and you are claiming the premium tax credit. Generally, you can use the worksheet in the Instructions for Form 1040 to figure your deduction. However, if any of the following apply, you must use the worksheet in chapter 6 of Pub.

Sales returns and allowances are contra revenue accounts in the financial statements. However, a contra revenue account is a debit account. Contra revenue accounts coexist with revenue accounts.

Are sales return a debit or credit?

The IRS also offers electronic versions of IRS paper forms that can also be e-filed for free. Free File Fillable Forms is best for people experienced in preparing their own tax returns. Free File Fillable Forms does basic math calculations. This public-private partnership, between the IRS and tax software providers, what is federal excise tax, and when do you have to pay it makes approximately a dozen brand-name commercial software products and e-file available for free. You can review each software provider’s criteria for free usage or use an online tool to find which free software products match your situation. Some software providers offer state tax return preparation for free.

An employee usually has income tax withheld from their pay. If you do not pay your tax through withholding, or do not pay enough tax that way, you might have to pay estimated tax. If you cannot file your return on time, use Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, to request an automatic 6-month extension. For calendar year taxpayers, this will extend the tax filing due date until October 15. Filing an extension does not extend the time to pay your taxes, only the time to file the tax return. Some businesses offer free e-file to their employees, members, or customers.

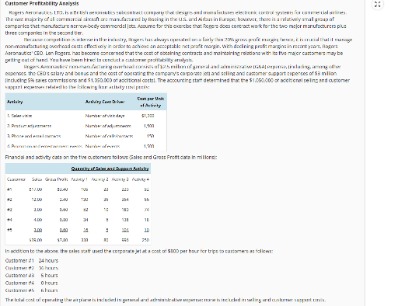

CUSTOMER SERVICE

When preparing a statement of income and expenses (generally, your income tax return), you must use your books and records for a specific interval of time called an accounting period. The annual accounting period for your income tax return is called a tax year. It can be tricky when it comes to accounting for sales returns and allowances but no worries.

If you finance the buyer’s purchase of your property, instead of having the buyer get a loan or mortgage from a third party, you probably have an installment sale. There are special methods of accounting for certain items of income or expense. If you want to change your method of accounting for inventory, you must file Form 3115, Application for Change in Accounting Method.

How to Record Sales Returns and Allowances? (Explanation and Journal Entries)

It is wages subject to social security and Medicare taxes (FICA), FUTA taxes, and income tax withholding. If Lizzie doesn’t use a sales returns and allowances account, she will deduct the return of lamps from B. In financial statements, particularly the income statement, “Sales Returns and Allowances” is deducted from the gross sales, resulting in net sales. This provides a more accurate picture of the actual revenue the business can expect to retain. The “Sales Returns and Allowances” account is used to track these transactions separately from regular sales, so businesses can monitor the amounts and reasons for returns and allowances. It provides insights into the quality of products, the accuracy of product descriptions, or potential issues with the sales process.

Generally, you will have a capital gain or loss if you dispose of a capital asset. For the most part, everything you own and use for personal purposes or investment is a capital asset. This section identifies some of the excise taxes you may have to pay and the forms you have to file if you do any of the following. An independent contractor is someone who is self-employed. You generally do not have to withhold or pay any taxes on payments made to an independent contractor.

Because if you sell products at your business, you know that not all customers are satisfied. If a customer wants to bring back an item, you need to make sales returns and allowances journal entries. For the seller, revenue can be revised by debiting the sales return account (A contra account by nature) and crediting cash/accounts receivable with the invoice amount. If your business has income from a source other than its regular business operations, enter the income on line 6 of Schedule C and add it to gross profit. Some examples include income from an interest-bearing checking account, income from scrap sales, income from certain fuel tax credits and refunds, and amounts recovered from bad debts.

Are You a Statutory Employee?

To qualify under the exclusive use test, you must use a specific area of your home only for your trade or business. The area used for business can be a room or other separately identifiable space. The space does not need to be marked off by a permanent partition.

- Income from work you do on the side in addition to your regular job can be business income.

- If you have earnings subject to SE tax from more than one trade, business, or profession, you must combine the net profit (or loss) from each to determine your total earnings subject to SE tax.

- These procedures should ensure all items have been included in inventory and proper pricing techniques have been used.

- These are reductions from list or catalog prices and are usually not written into the invoice or charged to the customer.

Earnings on the contributions are generally tax free until you or your employees receive distributions from the plan. You may also be able to claim a tax credit if you begin a new qualified defined benefit or defined contribution plan (including a 401(k) plan), SIMPLE plan, or SEP plan. The credit equals 50% of the cost to set up and administer the plan and educate employees about the plan, up to a maximum of $500 per year for each of the first 3 years of the plan. You can generally deduct on Schedule C the pay you give your employees for the services they perform for your business. Fees you receive for services you perform as a notary public are reported on Schedule C. These payments are not subject to SE tax (see the Instructions for Schedule SE (Form 1040)). Do not include merchandise you receive on consignment in your inventory.

Accounting Treatment for Sales Returns

Maria Trading Company always sells goods to it customers on account. The company collects sales tax @ 7% on all goods sold by it and periodically sends the collected amount of tax to a tax collecting agency. A sales return is when a person returns a product back to a company. This can be because it was defective, incorrect, or not exactly what they wanted. The store will also need to update its inventory records to reflect the return of the product.

Gildan Activewear Reports Results for the First Quarter of 2023 and … – GlobeNewswire

Gildan Activewear Reports Results for the First Quarter of 2023 and ….

Posted: Wed, 03 May 2023 07:00:00 GMT [source]

However, it does not imply it is a trade or cash discount. Instead, companies offer a sales allowance after when it makes sales. Trade discounts usually involve a reduction in price before the sale occurs.

The amount of any payroll tax credit taken by an employer for qualified paid sick leave and qualified paid family leave under the Families First Coronavirus Response Act and the American Rescue Plan Act. However, whether they are independent contractors or employees depends on the facts in each case. The general rule is that an individual is an independent contractor if the person paying for the work has the right to control or to direct only the result of the work and not how it will be done. The earnings of a person who is working as an independent contractor are subject to self-employment tax.

For more information about deducting insurance, see chapter 6 of Pub. You may be able to deduct the amount you paid for medical and dental insurance and qualified long-term care insurance for you and your family. You can generally deduct premiums you pay for the following kinds of insurance related to your business.